7/10/25 Roundup: A Coiled Spring: The New Monetary Epoch Nears

Brian Cubellis | Chief Strategy Officer

Jul 10, 2025

Bitcoin briefly traded above $112,000 yesterday afternoon.

More important than the ongoing price spike is the quiet momentum building beneath the surface. We are in the midst of a structural shift in adoption, strategic reserve allocation, corporate accumulation, and institutional behavior.

BlackRock’s bitcoin ETF (IBIT) is now more profitable than its flagship S&P 500 ETF, underscoring where investor demand and fee revenue are flowing.

Texas (the world's 8th largest economy) is preparing a $10 million BTC purchase through its Strategic Bitcoin Reserve legislation, set to begin as early as September.

Corporate treasury demand continues to accelerate, with most purchases still just announced, and not yet executed.

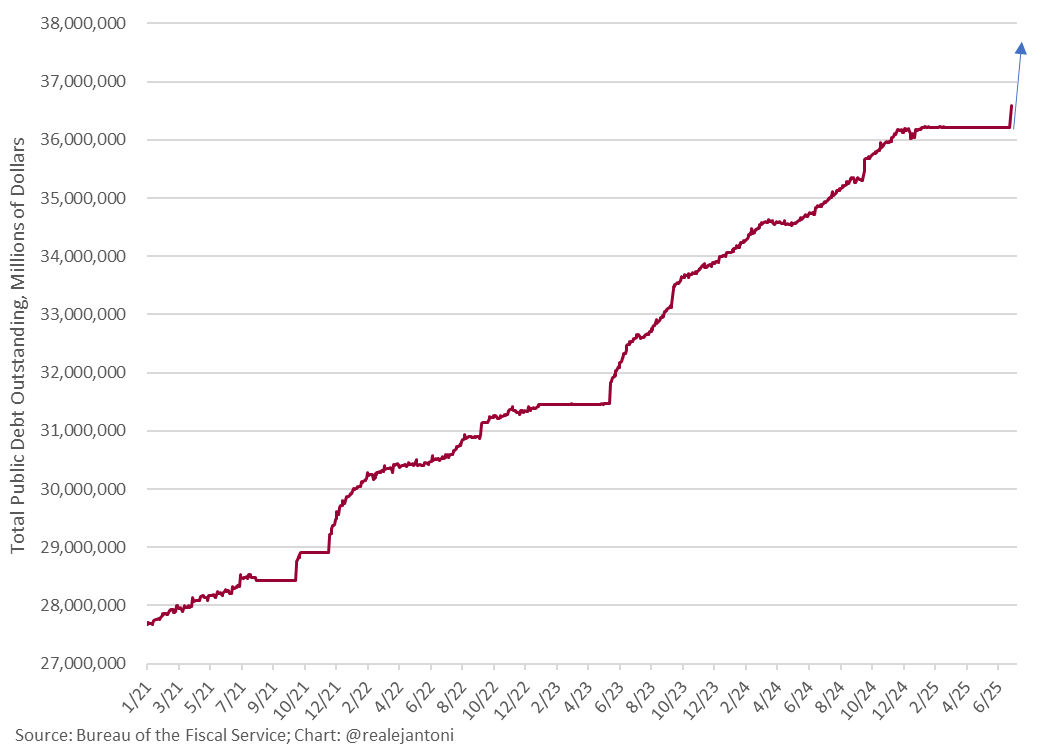

The dollar is weakening as deficits grow, another debt ceiling was quietly raised, another massive spending bill passed, and any semblance of fiscal discipline is out the window.

Bitcoin’s credibility is rising as trust in fiat erodes, the Overton window has shifted, governments aren’t debating whether to ban it, but they’re considering how to acquire it.

The signal is clear: institutional, corporate, and even sovereign bitcoin accumulation are no longer theoretical scenarios. These shifts are already in motion, shaping the foundation of a new monetary era.

As the stakes rise, resilience in custody becomes non-negotiable.

Bitcoin is not a traditional financial asset. It’s a digital bearer instrument. That distinction brings enormous benefits—but only if custody reflects its native architecture.

Single-entity custodians, ETF wrappers, and public equity proxies introduce exactly the kinds of centralized risks bitcoin was built to avoid.

A better approach is gaining traction: multi-institution custody (MIC), which distributes control, minimizes trust, and eliminates single points of failure.

This week’s episode of The Last Trade features Zack Shapiro and Zack Cohen from the Bitcoin Policy Institute. Together, we unpack BPI’s newly released State-Level Strategic Bitcoin Reserve Toolkit—a detailed legislative blueprint for how states can responsibly acquire and secure bitcoin using protocol-native infrastructure like MIC.

Onramp worked directly with BPI to shape the custody framework outlined in the toolkit. At the Bitcoin Policy Summit last month, we also led a dedicated Office Hours session on how MIC eliminates single points of failure and provides fault-tolerant custody for institutions.

Key Highlights:

➤ Multi-Institution Custody as Infrastructure: The toolkit recognizes MIC as the most secure and resilient architecture for sovereign-grade custody. Leveraging three independent keyholders within a 2-of-3 signing quorum, MIC enables distributed control and ownership assurances, with no unilateral access or single points of failure.

➤ Executive Accumulation May Be Imminent: While the Bitcoin Act (Lummis bill) continues its legislative journey, a separate executive-driven bitcoin accumulation initiative could be announced as soon as late July. It may be smaller in scale and less robust, but it would mark a significant signal of federal intent.

➤ States Face Hard Constraints: States can’t print money. Inflation hits them directly. As debt monetization accelerates, some are moving first—exploring direct BTC reserves, bitbonds, pension allocations, and bitcoin opportunity zones.

➤ Custody is the Bottleneck: The report is clear: secure custody is paramount. If bitcoin is to be credibly held on public balance sheets, it must be secured in a way that reflects its core design—verifiable, distributed via bitcoin-native multisig, and resistant to compromise or capture.

➤ A Legislative Blueprint for Sound Money: This is a roadmap for fiscal and monetary resilience. For states ready to lead, the toolkit offers a practical, legally grounded framework for adopting bitcoin as a reserve asset—without political theater or centralized risk.

Charts of the Week

"And so it begins...debt jumps $366 billion in one day."

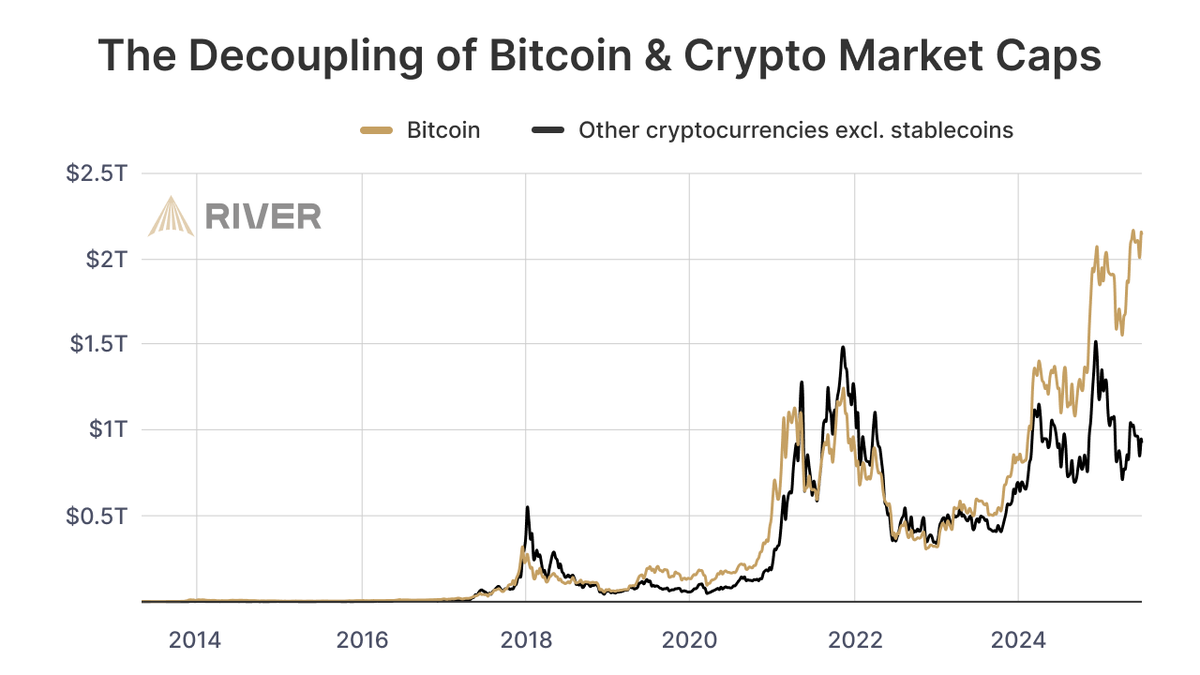

"The world is beginning to wake up to this simple truth: bitcoin, not crypto."

Quote of the Week

"The case for altcoins has arguably never been weaker. And given their horrible track record in aggregate, I think that’s healthy. The altcoin industry has seemingly run out of narratives for now on how to substantially pump their networks. It makes far more sense to hold bitcoin directly, and/or to invest or speculate in companies that combine bitcoin with optimal types of leverage, than it does to buy altcoins."

Podcasts of the Week

The Strategic Bitcoin Reserve Playbook: Inside BPI’s Toolkit for Sovereign Adoption

In this special episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, & Brian Cubellis, are joined by Zack Shapiro and Zack Cohen of the Bitcoin Policy Institute to unpack their newly released State-Level SBR Toolkit, a modular framework for states to hold bitcoin securely and responsibly.

Fiat Is Hopeless: Musk’s America Party Makes Its Bitcoin Pitch

In this episode of Final Settlement, hosts Michael Tanguma, Liam Nelson, & Brian Cubellis discuss business builders opting out of broken systems, SoFi’s BTC remittance play, AI’s cognitive cost, the bitcoin–gold barbell, Thiel & Luckey’s crypto bank bet, & more!

Former Blackstone Partner: ALL-IN on Bitcoin's Monetary Revolution

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, & Brian Cubellis, are joined by David Thayer, former Blackstone Partner, to discuss July 4th & bitcoin as the new monetary revolution, bitcoin’s role in a liquidity-driven market, distorted valuations & equity breadth, nominal versus real returns, the rise of the Orange Party, & more!

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis