6/12/25 Roundup: A Very Different Cycle: Bitcoin’s 2025 Setup

Brian Cubellis | Chief Strategy Officer

Jun 12, 2025

As bitcoin flirts with new all-time highs, some market participants are once again calling for a "top" — pointing to surface-level chart similarities to the 2021 double peak. On a price chart alone, one could argue that today’s range echoes that previous cycle. But beneath the surface, both structurally and fundamentally, this environment could not be more different.

In many ways, these calls for a top reflect a failure to recognize how far bitcoin’s adoption curve, monetary role, and market structure have evolved since 2021.

The On-Chain Picture: Nowhere Near Extremes

On-chain data tells a very constructive story. Most notably:

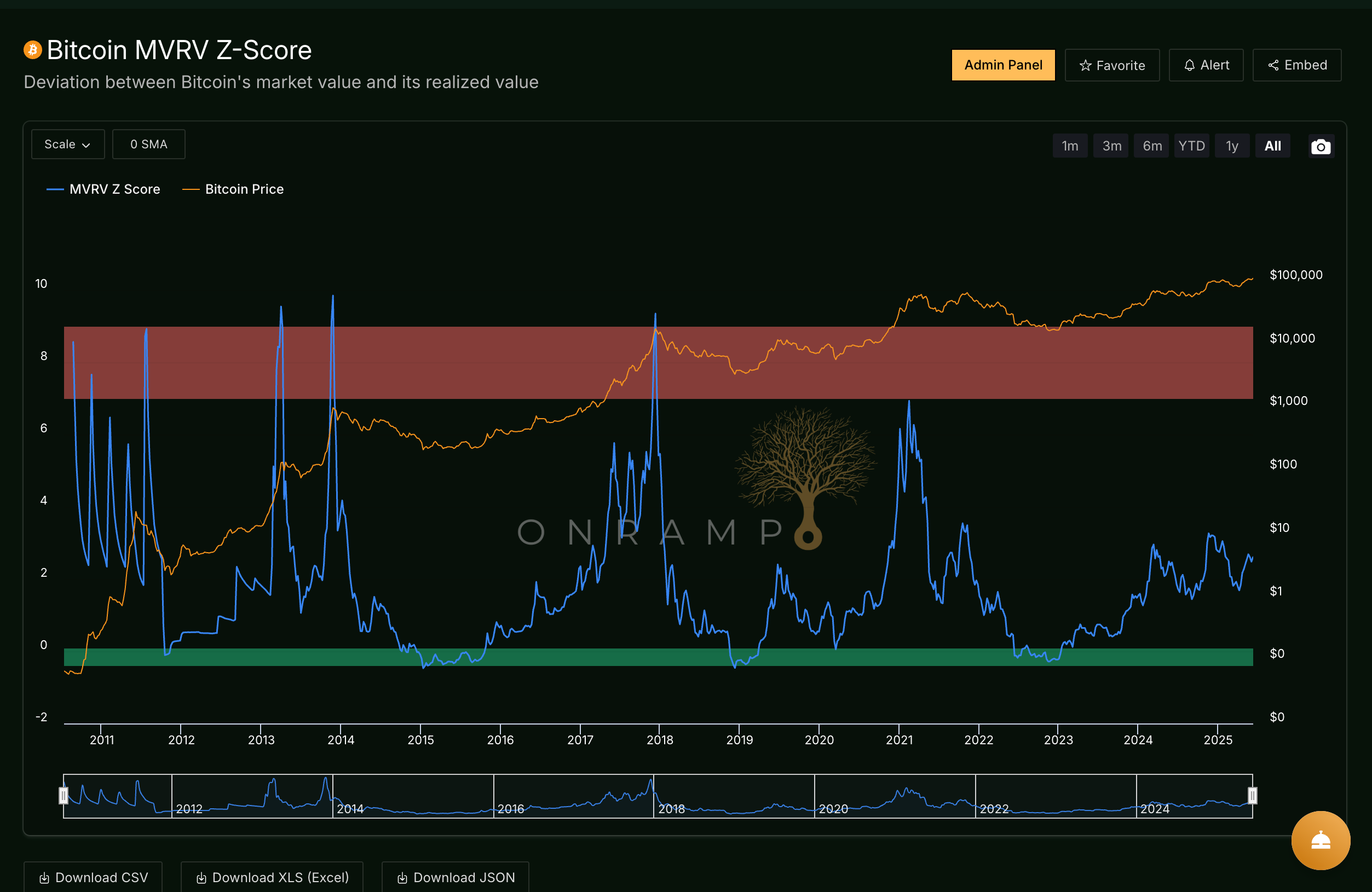

MVRV Z-Score remains muted: Currently hovering around ~2.5, far below the typical euphoric levels of 7–9 that have historically marked major cycle tops. Long-term holders are distributing some coins into strength — a natural part of any healthy market — but the bid beneath them is fundamentally different this time.

Consistent bid from new classes of buyers: The steady absorption is no longer driven by short-term traders but by institutions, corporates, sovereigns, and structurally sticky buyers who were largely absent in prior cycles.

The result is an environment where realized profits are orderly and well-distributed, not crowded and frothy.

Supply Integrity, Leverage, and Liquidity

The structural backdrop today stands in stark contrast to the conditions that created the 2021 double top:

The FTX effect: In 2021, FTX and related entities were effectively creating “paper bitcoin” — synthetic exposure and off-balance sheet leverage that artificially expanded circulating supply. That supply expansion ultimately exacerbated the drawdown when that leverage unwound.

Leverage reset: Today’s market is far less leveraged. Derivatives open interest remains well below 2021 levels relative to market cap. Excessive leverage was a major driver of 2021’s instability — its absence today suggests a far more stable foundation.

ETF-driven demand: The spot ETFs now serve as structurally sound, fully reserved buyers, consistently absorbing real coins from available free float. These flows are durable, regulated, and far more immune to the paper games of prior cycles.

Cleaner collateral base: With FTX, BlockFi, Celsius, and similar intermediaries gone, there’s far less hidden counterparty risk lurking beneath the surface.

Opposite Monetary Environments

Perhaps the most profound difference between today and 2021 lies in the macroeconomic backdrop:

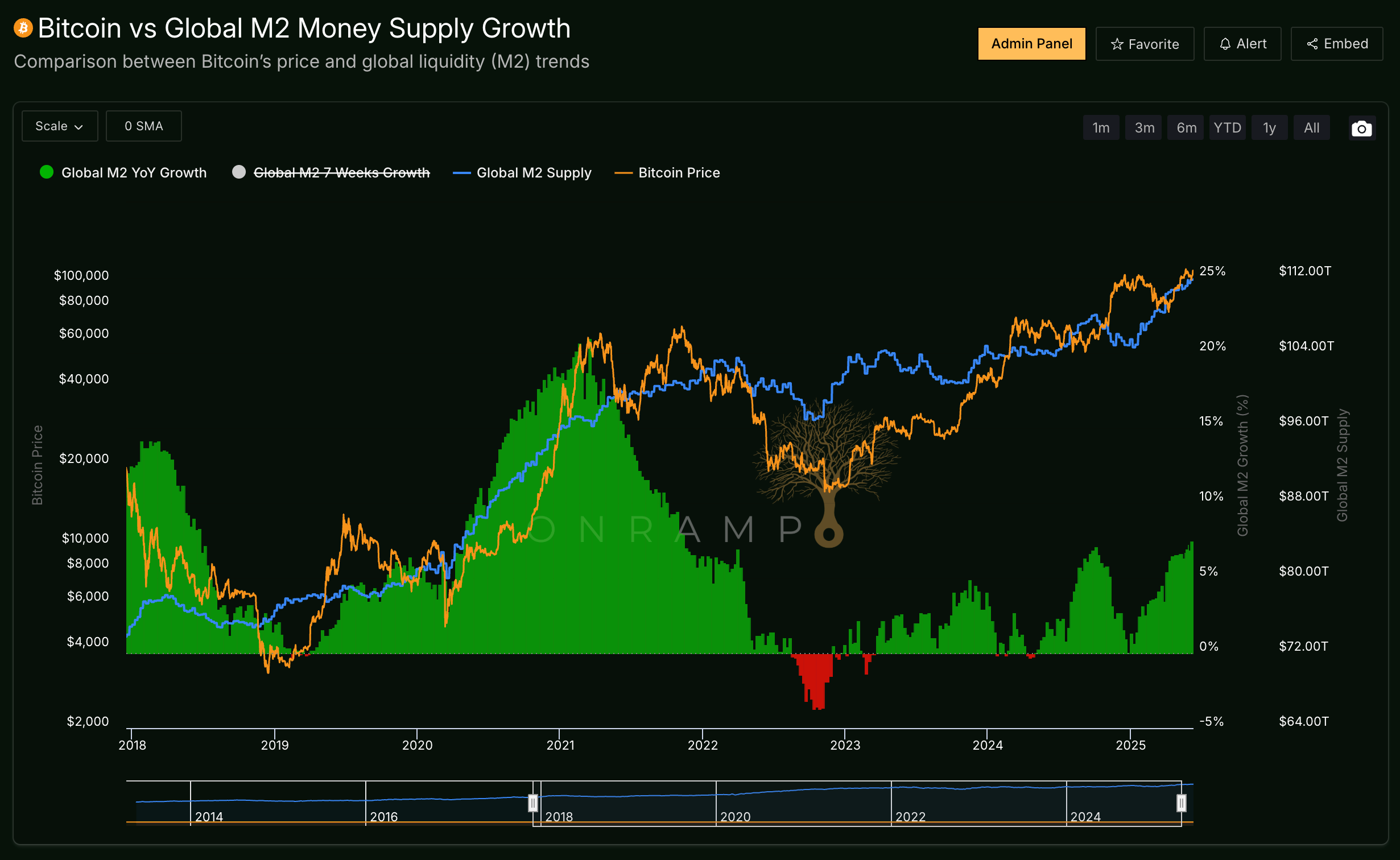

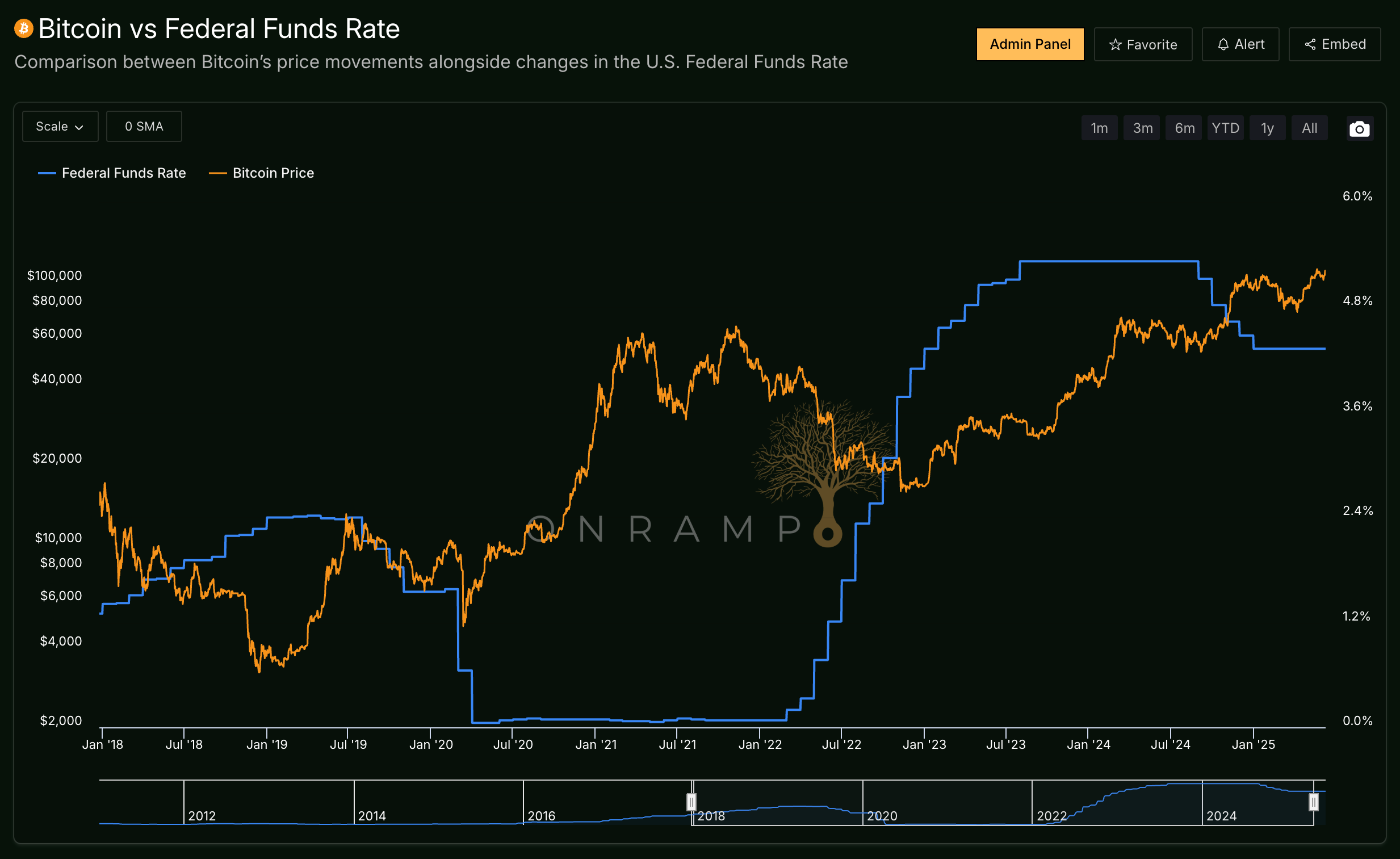

2021 preceded the fastest global tightening cycle in modern history. Inflation prints were accelerating, central banks were behind the curve, and liquidity was rolling over sharply. Bitcoin peaked into this tightening storm.

Today, we’re on the other side of that cycle. The Fed is nearing the end of its tightening, and the market is increasingly pricing eventual cuts. Global liquidity measures have already pivoted back upwards, providing a more supportive backdrop for scarce assets.

Global debt loads have ballooned even further, only strengthening bitcoin’s core monetary thesis as the world’s premier non-sovereign, non-credit-based monetary instrument.

The Overton Window Has Shifted

Beyond market structure and monetary policy, perhaps the most important change is the narrative evolution.

In 2021, bitcoin was still widely seen as a high-beta speculative tech proxy. Today, the market increasingly recognizes bitcoin’s nature as digital sound money — a non-sovereign reserve asset, not a venture bet.

The comparison set has shifted. Bitcoin is being discussed alongside gold, treasuries, and sovereign wealth reserves — not altcoins or meme stocks.

The regulatory climate is also completely transformed. In 2021, a hostile Biden SEC actively blocked ETF approvals and constrained institutional adoption. Today, the U.S. government itself has formally established a Strategic Bitcoin Reserve. The Trump administration is broadly supportive of both sovereign and institutional bitcoin accumulation, with supportive legislation advancing at both federal and state levels.

Multiple states — including Texas, which would be the world’s 8th largest economy if independent — are actively passing Strategic Bitcoin Reserve legislation.

Leading financial institutions who once ignored or dismissed bitcoin (e.g. BlackRock, Goldman, JP Morgan) are now offering access and building infrastructure to meet growing demand.

Cycles May Look Different From Here

One of the more subtle but important shifts is that “bitcoin cycles” as previously understood may not apply as cleanly going forward.

The halving remains part of bitcoin’s structural rhythm, but price cycles are increasingly driven by broader liquidity cycles, not crypto-native speculative blow-offs.

Volatility has compressed significantly. Bitcoin’s realized volatility is now comparable to several of the MAG7 equities. This reflects growing depth, liquidity, and institutional participation.

Corporate, sovereign, and institutional buyers are now a permanent fixture. This is a key difference — there are structurally larger, fundamentally driven allocators stepping in on dips, helping smooth out what were once extremely sharp cyclical drawdowns.

The Overton window has shifted from “if bitcoin succeeds” to “how widely and rapidly it gets adopted.”

This doesn’t mean price won’t experience volatility, but it does mean we’re transitioning out of the early, hyper reflexive boom-and-bust dynamic of prior cycles into something much more structurally durable. Investors relying purely on prior cycle charts may increasingly find themselves using the wrong framework.

Simply Put: This Is Not the Top

To be clear: bitcoin will remain volatile. There will be sharp corrections and consolidations. That is the nature of a free market monetizing itself globally. But structurally, this is not the late-stage blowoff some are prematurely calling for.

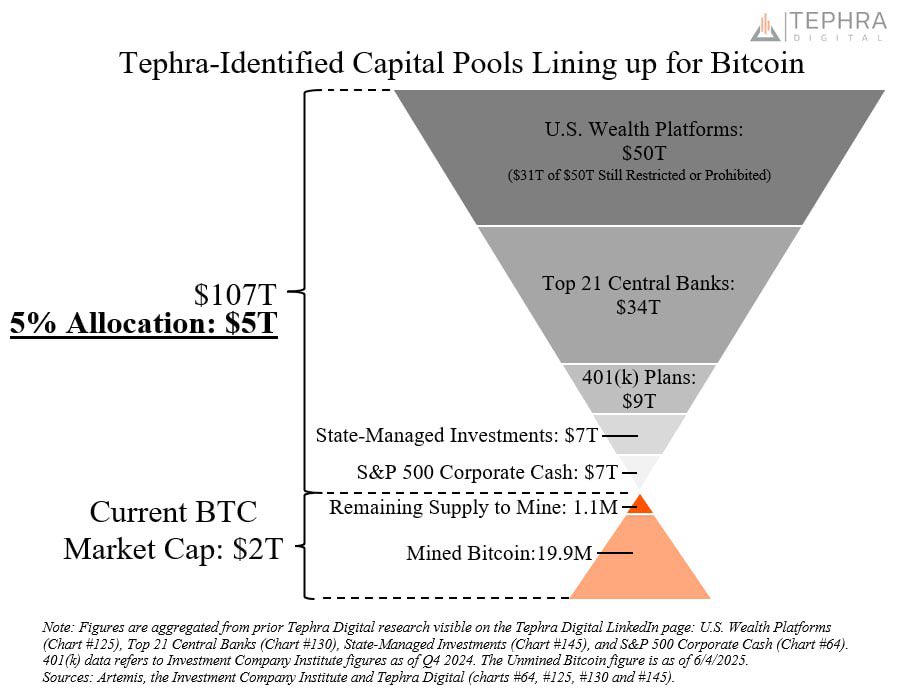

- We remain very early in the broader adoption cycle.

- Most retail participants are still under-allocated or completely absent.

- Institutional penetration remains minimal outside of a few bellwethers.

- Global sovereign adoption is just beginning.

The flow of capital into bitcoin is still in its infancy when viewed against the ~$1 quadrillion global asset landscape — spanning fiat currencies, sovereign debt, real estate, corporate equity, and alternative stores of value.

Bitcoin’s free float continues to shrink while its role in the global financial system quietly expands. Every day, new allocators, corporate treasuries, state actors, high-net-worth families, and individual savers take their first steps into bitcoin exposure. This is what long-term monetization looks like.

The temptation to call tops will always be present — especially for those still anchored to prior cycle patterns. But that framework increasingly fails to capture the new dynamics shaping bitcoin’s role in the global monetary order. Higher.

Chart of the Week

"$107 trillion in capital identified.

A 5% allocation = $5T.

Only 1.1 million Bitcoin left to mine. 62% of active supply hasn’t moved in over a year. This may be the greatest supply-demand mismatch in financial history. It won’t happen overnight - but this is the direction. For context: $5T is 116x larger than all net flows into Bitcoin in 2024."

Quote of the Week

"While everyone celebrates the fact that inflation came in under expectations, it is worth noting that prices are *still rising*, the dollar is *still debasing* and only hard assets like Bitcoin can protect you from this relentless hidden tax."

Podcasts of the Week

Strategic Reserves, Fiscal Insanity, and the Bitcoin Explosion Ahead with Alex Thorn

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, & Brian Cubellis, are joined by Alex Thorn, Head of Research at Galaxy Digital, to break down the bitcoin PubCo boom (and risks), “crypto meta” waves & cycle positioning, the US debt spiral, Trump, DC policy shifts, stablecoins, dollar dominance, & more.

The $100 Trillion Unallocated Wall & Bitcoin’s Coming Supply Squeeze

In this episode of Final Settlement, hosts Michael Tanguma, Liam Nelson, & Brian Cubellis break down the stablecoin wars, Circle’s IPO, TradFi capital gearing up, geopolitics pushing bitcoin forward, global regulatory shifts & more.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis