4/10/25 Roundup: Tariffs, Treasuries, & the New Monetary Order

Brian Cubellis | Chief Strategy Officer

Apr 10, 2025

Tariffs, Treasuries, & the New Monetary Order

We’re wrapping up a week of breathtaking volatility. The White House launched an aggressive tariff push on April 2nd, spurring a steep slide in equities and triggering bond yield spikes over the following three market sessions. A rumored tariff pause on Tuesday the 8th initially sparked a market rally, only to reverse dramatically when the tweet was debunked.

Then yesterday, President Trump announced a 90-day pause on all tariffs—lowering them to a 10% floor for most countries but jacking up China’s rate to 125%. This latest twist unleashed one of the largest single-day stock rallies in recent history.

Across social media and mainstream press, opinions on President Trump’s tactics vary wildly—from praising his “art of the deal” genius to accusing him of shooting from the hip and backpedaling to placate markets.

The truth, as usual, likely rests between these extremes: the administration’s recent actions aren’t exactly “5D chess,” but neither are they directionless. It’s entirely plausible that crafting short-term uncertainty and chaos is part of a larger plan to force other nations to negotiate—while marginalizing dissenters, notably China.

Yet debating whether the strategy is cunning or reckless largely misses the big picture: we’re in the midst of a global economic and monetary reordering that’s now undeniably in progress.

Treasury Secretary Bessent’s Nod to Sound Money

Before the election, Treasury Secretary Scott Bessent—a self-proclaimed "gold bug" from his days on Wall Street—spoke about his fascination with monetary history, referencing Bretton Woods and his desire to “be part of” the next global economic reordering. He seems to grasp the concept of sound money, as evidenced by a recent interview where, in discussing gold’s tariff exemption and rally, he spontaneously invoked bitcoin as another store of value.

In line with that perspective, this administration has:

- Established a Bitcoin Strategic Reserve (though it’s still unclear how many BTC they hold), with line of sight to accumulate more.

- Actively endorsed stablecoins to spread dollar usage globally—potentially offsetting weakened demand for U.S. Treasuries.

When you zoom out, the administration’s goals become clearer:

- Undermine competing fiat currencies (particularly the yuan) through trade wars and tariff threats.

- Support the dollar system (and embrace stablecoins to further dominance), fully aware that go-forward money-printing and debasement are inevitable.

- Acquire hard assets—including but limited to gold, minerals, energy infrastructure, manufacturing capacity, and bitcoin.

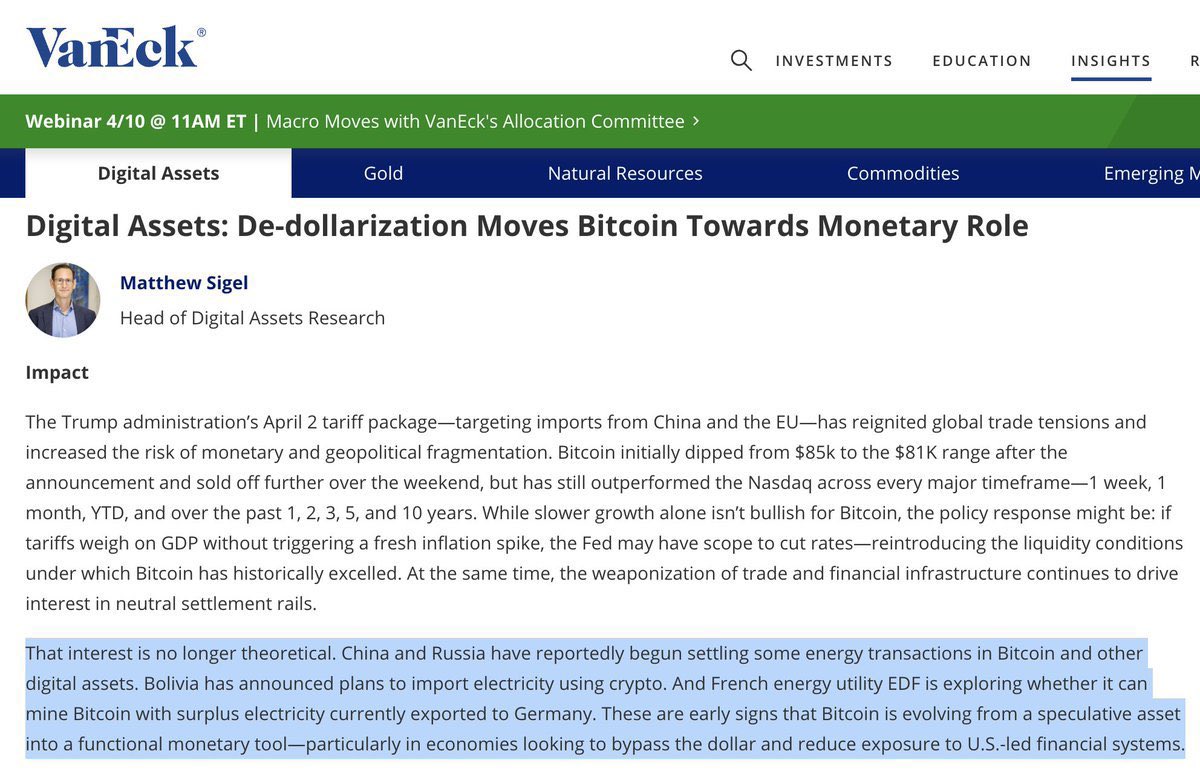

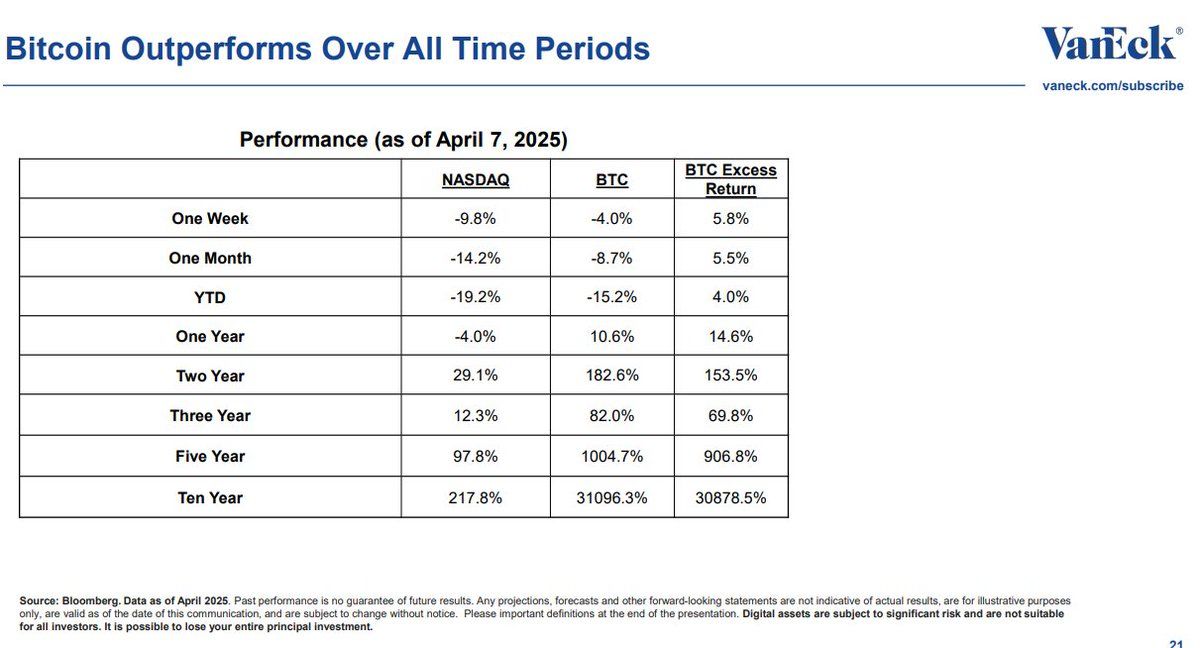

This shift extends beyond the United States. Various signals suggest other nations are also adopting neutral reserve assets; for instance, China and Russia are reportedly settling certain energy deals in bitcoin (according to VanEck below).

Fiat Faith in Decline—A Multipolar Future

Regardless of whether Trump’s tariff strategy “works,” the global monetary tectonics have been shifting since Russia’s U.S. treasuries were frozen in 2022. Faith in both the U.S. government’s creditworthiness and the broader concept of “inside money” is waning. We appear to be moving from hyper-globalization to a multipolar world with record-low institutional trust. As a result, demand for credibly neutral, censorship-resistant assets—like bitcoin—keeps growing.

This is why bitcoin exists. It no longer matters what any particular nation thinks of you, your policies, or your alliances—bitcoin can’t be debased or seized by state decree. While gold should also thrive in this environment, legendary investor Paul Tudor Jones famously observed that bitcoin is the “fastest horse.” It’s the purest form of scarcity ever devised by humans, engineered for a digital age where trust in fiat and global cooperation both show signs of wear.

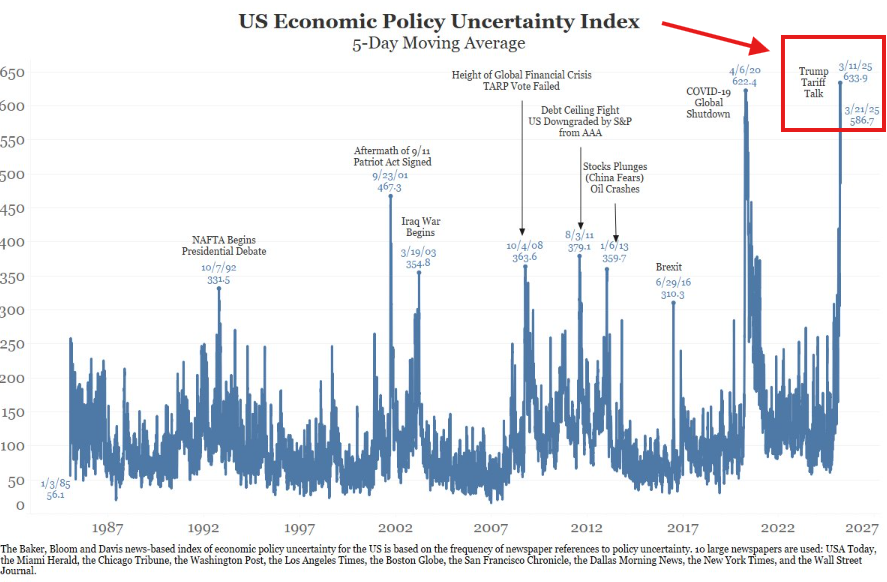

Chart of the Week

Quote of the Week

"There are a lot of different stores of value over time. Bitcoin's becoming a store of value, gold has historically been a store of value."

— US Treasury Secretary, Scott Bessent

Podcasts of the Week

BlackRock, Trump, and the Great Bitcoin Repricing

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, Brian Cubellis, & Tim Kotzman discuss BlackRock’s influence & ETF success, the signal of gold ATHs, Circle’s IPO & the evolution of stablecoins, the Trump admin’s involvement in bitcoin & more.

Beyond Store of Value: Bitcoin and Lightning Are the Real FinTech Opportunity

In this episode of Final Settlement, hosts Brian Cubellis & Liam Nelson are joined by Graham Krizek of Voltage and Pierre Corbin of Flash to discuss bitcoin’s payments potential, the role of stablecoins in adoption, the state of the Lightning Network, the power of interopable protocols, Nostr Wallet Connect, eCash, Liquid & more.

The Next Bretton Woods Is Here | Inflation, Bitcoin, and the Global Reset

In this episode of Scarce Assets, host Jackson Mikalic is joined by Kane McGukin of Arkos Global Advisors to discuss the myth of bond market safety, stablecoins as the new liquidity layer, early stages of a monetary reset & more.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis