Announcing: Onramp Launches First Spot Bitcoin Fund to Leverage Multi-Institution Custody

When you realize you need a bitcoin allocation in your portfolio, immediately you face a problem – one that usually goes unspoken. How do you get direct exposure to bitcoin in a manner that optimizes both efficiency and security?

Onramp’s collective experience in the Bitcoin space has proven to us that self-custodied bitcoin is the gold standard, and what everyone should eventually strive for. However, the technical requirements of self-custody lead many individuals and institutions to resort to poor alternatives with major drawbacks, like GBTC.

Over the past 5 years of onboarding thousands of HNWI, Family Offices, and Institutions to the ecosystem, we have learned that most individuals and institutions are not ready to manage self-custody at the beginning of their Bitcoin journey. The requirements of safeguarding cryptographic private keys demand new capabilities, decision rights, and organizational processes. It’s a heavy lift when you’ve only just begun learning about Bitcoin.

That’s why we built Onramp.

We solve for the three pillars of bitcoin ownership; we facilitate accumulation of the asset, we orchestrate the optimal custody solution, and we educate holders to appreciate the long-term signal value of the asset while ignoring the short-term noise that twitter and mainstream media propagate.

Onramp was designed from the ground up for HNWI, Family Offices, Investment Funds, Corporations, and Institutions that want best-in-class custody without any tradeoffs, but are not yet ready to take on the responsibility of self-custody.

Onramp combines the best of a Bitcoin financial service company with traditional finance experience. Our team hails from Unchained Capital and Bain & Company and we are advised by professionals with tenures at organizations including BNY Mellon, Greenlight Capital, and Deutsche Bank.

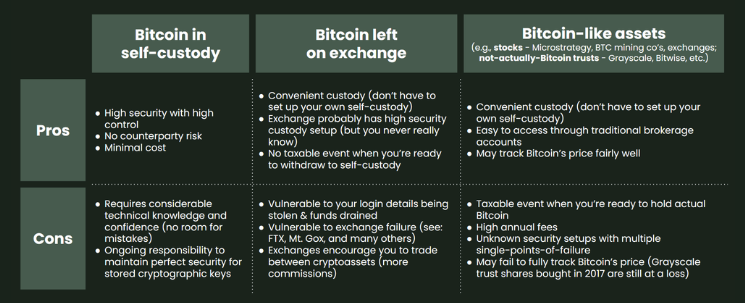

The Onramp team has built the solution to onboarding HNWI and institutional investors who are ready for bitcoin exposure, but not yet prepared for the responsibilities of self-custody. The current landscape offers three main options that people choose from (usually without being aware of the full set of options). Each of these has pros and cons, let’s briefly take a look…

In addition to bitcoin-like assets, there are other direct exposure bitcoin fund vehicles, but they fall short in three key ways:

-Custody with a single-point-of-failure

-Taxable event on withdrawal

-Lack of Bitcoin focus and education

The Bitcoin landscape deserves better. Onramp delivers:

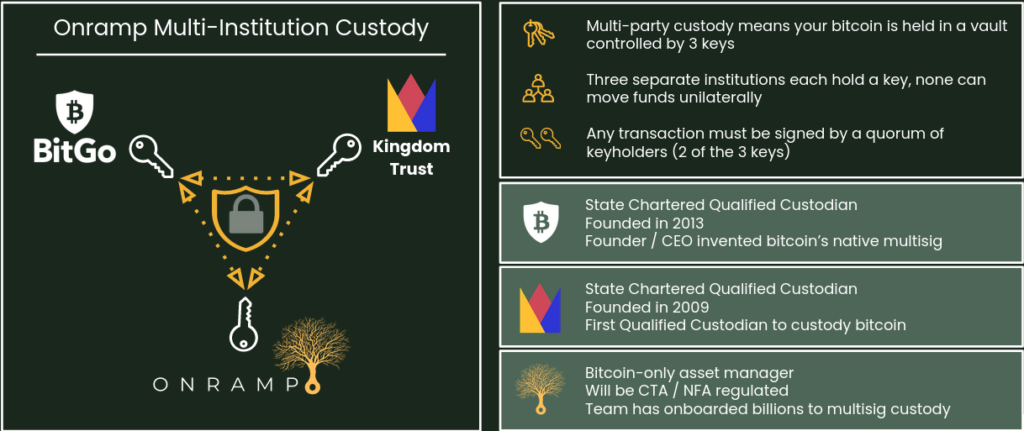

1) The Onramp Multi-Institution Custody Solution

At the heart of Onramp is a best-in-class custody solution for anyone who is not yet ready for self-custody. Using industry-standard collaborative custody processes, Onramp custodies assets in a multi-party vault.

The core idea is that the vault is controlled by 3 keys. These 3 keys are each held by a different institution. To control the assets in the vault, 2 of 3 keys need to approve any transaction. This makes Onramp’s custody solution fault tolerant with no single-point-of-failure.

As part of this arrangement, Onramp is proud to collaborate with BitGo, the industry leader in collaborative custody Bitcoin technology, and Kingdom Trust, a Qualified Custodian in the traditional asset management space. For individuals and institutions looking to have a Qualified Custodian as part of their Bitcoin custody arrangement, Onramp has built the solution you’ve been looking for.

2) No taxable event on Bitcoin withdrawal

We understand Bitcoin. So, we understand that many people eventually decide to self-custody their bitcoin. With existing direct exposure bitcoin funds, this means a taxable event on withdrawal. Onramp was designed to allow for bitcoin withdrawals that do not trigger a taxable event for the investor.

If your bitcoin investment pays off and appreciates significantly in value, the last thing you want is to face a hefty capital gains tax bill when you decide you’re ready to take self-custody. Onramp’s structure allows investors to withdraw their bitcoin when they’re ready without triggering a taxable event.

3) Bitcoin-only, with a commitment to education

The best way to get started in Bitcoin is by partnering with a company that deeply understands Bitcoin and is committed to Bitcoin education. Onramp was born from this idea. Most platforms that help you gain exposure to Bitcoin take your dollars and convert that money to bitcoin and that’s that. Onramp views it differently.

When you invest in bitcoin, you are not done learning about Bitcoin. Onramp is committed to building its clients’ Bitcoin knowledge and understanding. Our role is to be a partner, a trusted guide on your Bitcoin journey. That means helping you learn enough to navigate bitcoin’s volatility, prepare you to take self-custody when you’re ready, and most importantly, help you avoid the many perils in “crypto” that can hoodwink the uninitiated.